Why Most Self-Employed Mortgage Applications Fail, And How to Get Approved

A specialist preparation plan built from real self-employed mortgage cases, backed by 1,000+ Trustpilot reviews and years of broker-led experience.

Learn how lenders really assess self-employed applications

Get your profile prepared properly before you apply

Avoid unnecessary declines, delays, and credit damage

Free lessons. No credit checks. No obligation.

WATCH THIS 60-SECOND VIDEO FIRST

DAVID HAMBLETT, DIRECTOR OF NEW WAVE

Built from real self-employed mortgage cases. No calculators. No guesswork.

QUESTION FOR YOU...

Does this sound familiar?

You’re earning well but keep getting told you’re “not mortgage-ready.”

You’re self-employed and no one seems to understand how your income works.

You’ve saved a deposit, but still feel miles away from approval.

You’ve tried researching online, but the advice is outdated, confusing or contradictory.

Mortgage Specialists for the Self-Employed

For over a decade we’ve helped self-employed clients get approved where banks and standard brokers often struggle.

After seeing the same avoidable issues cause delays and declines, this bespoke course was built to show you exactly what lenders look for — before you apply.

It’s a clear, structured process designed to help you prepare properly and avoid unnecessary setbacks potentially costing you thousands of pounds.

FCA regulated mortgage brokers

50+ years combined experience

Secured 1000’s of successful approvals

The Real Difference Between Approval and Decline

Most self-employed applications fail because they’re submitted without proper preparation. The right plan isn’t about doing more. It’s about preparing the right things, in the right order, before a lender ever sees your application.

Inside Mortgage Ready in Less Than 12 Months, we show you how to build that plan step-by-step:

How lenders actually assess self-employed applications

What to prepare before submitting an application

When timing materially improves approval chances

What This Process Covers

A structured preparation process designed to remove uncertainty

Based on the same preparation used on real client applications

Step 1: Identify the Real Problem

Understand why most self-employed applications fail and what’s actually holding yours back.

Step 2: Create Clarity

Learn how lenders assess self-employed applications and what really matters before you apply

Step 3: Prepare Correctly

Address credit, income, documents, and timing in the right order — before mistakes are made.

Step 4: Apply With Confidence

Know when you’re ready to apply and how to approach the process without unnecessary risk.

No contracts - cancel anytime

JOIN US & CHANGE YOUR LIFE

Unlock the Full Course + Community Access

Go beyond the free modules and get everything you need to fast-track your mortgage journey - plus direct support from experts who do this every day.

Get instant access to:

All 12 modules - step-by-step guidance for every stage

Exclusive community of self-employed buyers

Monthly live Q&A calls with David & the New Wave broker team

Templates, scripts, and checklists that make lenders say “yes” faster

Total value: £297

Today: £14.99 / monthly or just £59 for 6 months

"Best purchase ever!"

"Testimonial lorem ipsum dolor sit amet, consectetur adipisicing elit." - Name

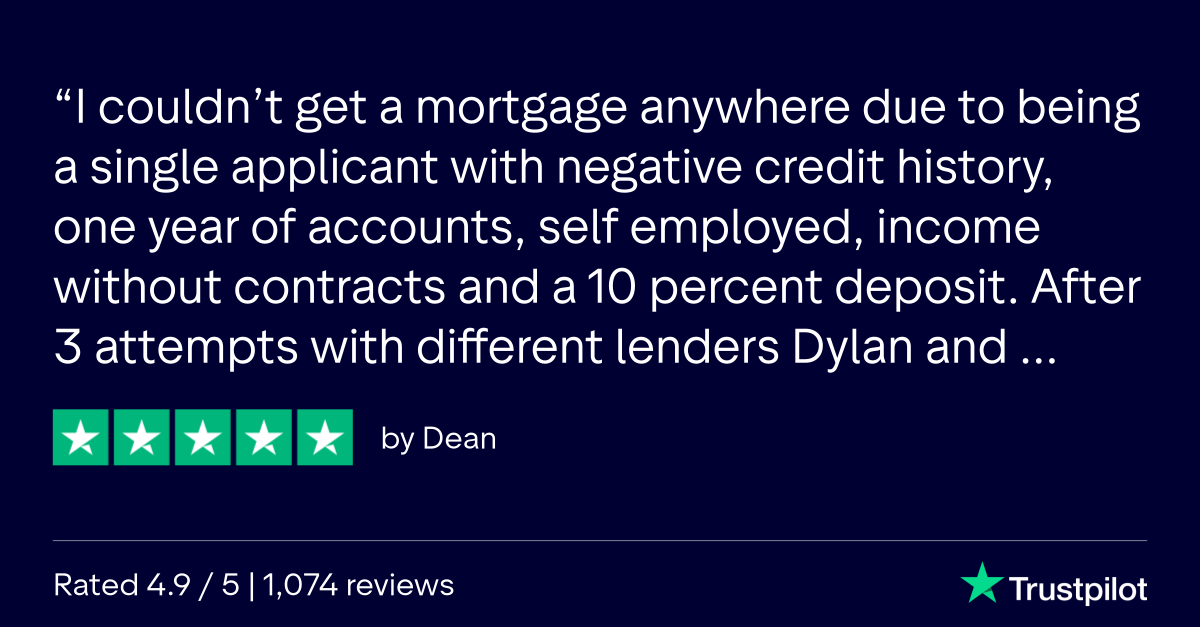

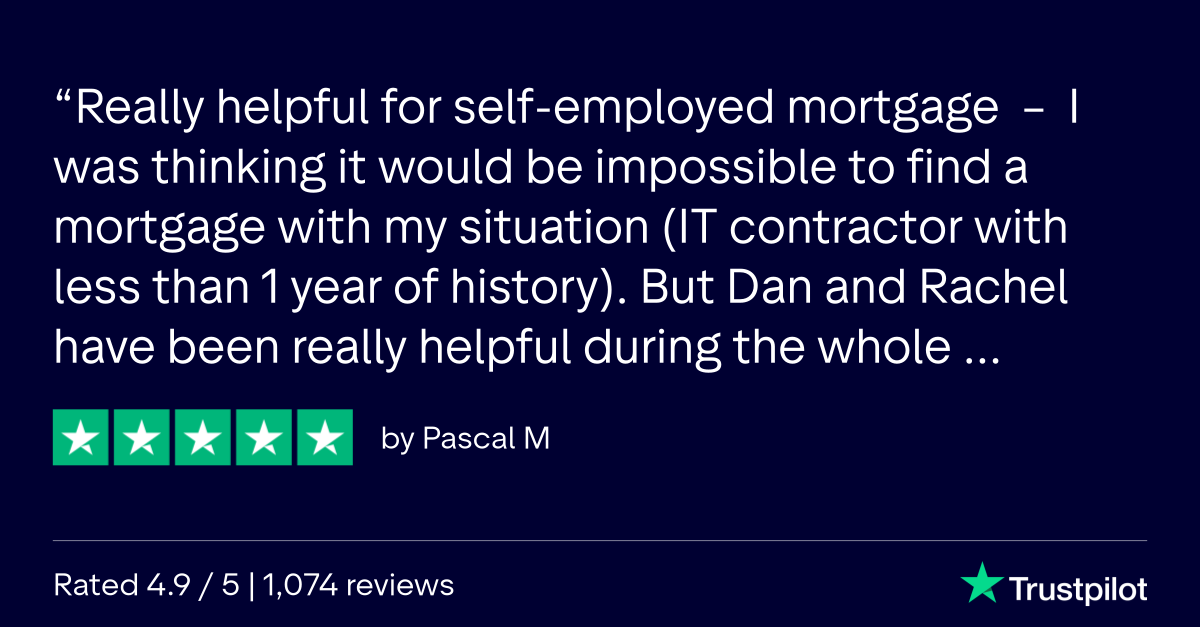

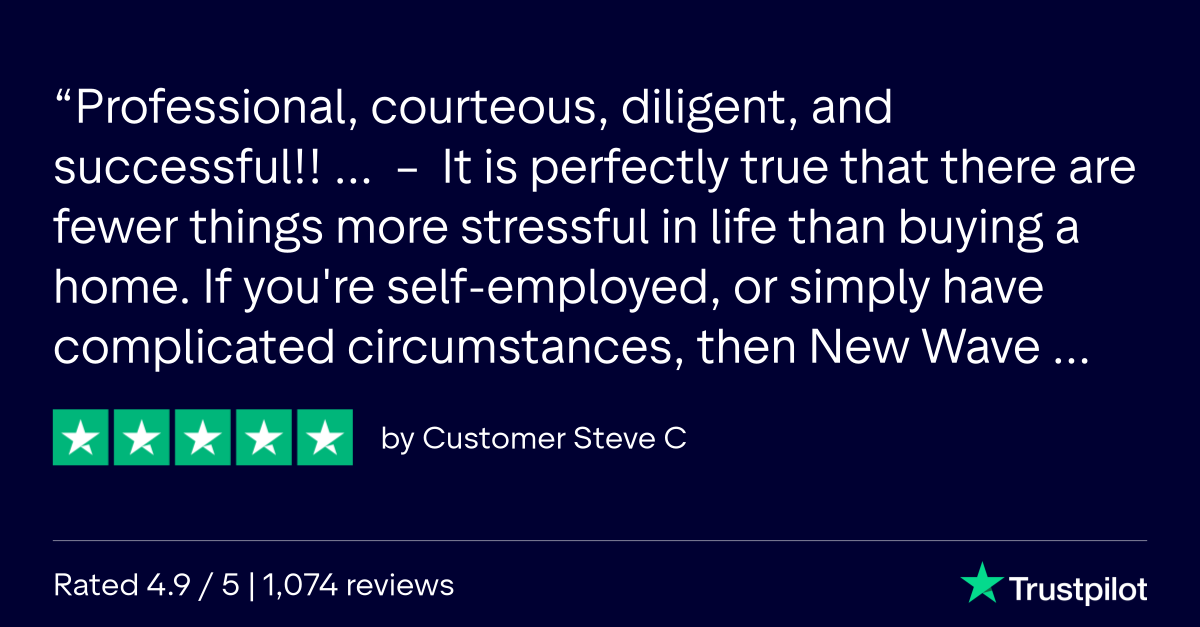

TESTIMONIALS

Why People Recommend Us

This is just a few reviews people have left us after experiencing the power of the community.

No contracts - cancel anytime

GOT QUESTIONS? LET'S ANSWER THEM!

Frequently Asked Questions

We understand lorem ipsum dolor sit amet, consectetur adipisicing elit.

What if I’m not ready to buy yet?

That’s exactly who this is for. You’ll learn what to do step-by-step so you’re fully ready when the time comes.

Is this financial advice?

The course is educational, designed by qualified mortgage advisors to help you understand the process before applying.

What happens after the free modules?

You can upgrade anytime to unlock the full course, coaching calls, and community.

Can I cancel anytime?

Yes, you can stop your subscription at any time.

THINK CAREFULLY BEFORE SECURING OTHER DEBTS AGAINST YOUR HOME. YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON A MORTGAGE OR ANY OTHER DEBTS SECURED ON IT.

New Wave Financial Services Limited is authorised and regulated by the Financial Conduct Authority. Our FRN number is 779395 and can be found on the Financial Services Register https://register.fca.org.uk. The FCA does not regulate some forms of Buy to Let mortgages. The guidance and/or advice contained within this website is subject to the UK regulatory regime, and is therefore targeted at consumers based in the UK.

© 2025 New Wave Financial Services| Terms & Conditions